Chase Sapphire Reserve Card Travel Protection Insurance is a Scam

By Luanne Teoh

Sep 4, 2019,

By Luanne Teoh

Sep 4, 2019,

If you have been thinking about getting a Chase Sapphire Reserve card which automatically comes with travel insurance and trip protection, I urge you to read this post before you do.

There is a $450 annual fee for the Chase Sapphire Reserve card which automatically comes with $10,000 worth in travel protection and insurance for one year when you use the Chase Sapphire Reserve card to pay for your flight tickets.

It’s an amazing card when you factor in the main benefits;

- 3x the points for all dining and travel related purchases.

- $300 credit to your $450 annual fee for travel related purchases.

- $10,000 in insurance and trip protection coverage annually.

If you travel often, paying $450 a year to get $10,000 in coverage for trips annually is well worth it. That was the icing on the cake and the main reason we switched from Chase Sapphire Preferred card with a $95 annual fee to Chase Sapphire Reserve with a $450 annual fee.

The additional $355 a year was well worth it for the peace of mind should you ever need to cancel or change your trip.

Except when you’re not covered.

We booked tickets to Europe in Dec 2018 for a May 2019 trip for Molly’s sister’s 50th surprise birthday party.

In late March 2019, a dreaded phone call came.

My brother in Malaysia called me and I was told that our dad had been diagnosed with stage 4 pancreatic cancer and was given 6 months to live.

Naturally, we could not go to Europe in May and we had to take an unplanned trip to Malaysia instead. We had also booked return tickets from Malaysia back to Hawaii two weeks out thinking we may return home then and take our trip to Europe from Hawaii since the tickets flew out of Honolulu.

We went to Malaysia on May 1st and by mid May we had to transfer my dad to a full-time nursing home and hospice care. There was no way we could leave as he was deteriorating fast and needed our help.

I submitted the claims within the first week of May to Eclaimsline (Chase’s trip protection insurance partner) saying we will not be able to make the trip to Europe and return flights back to Hawaii. I submitted all the paperwork they required and asked for. This was at least 3 weeks before our flight to Europe on May 29th, 2019.

We submitted a laundry list of items based on everything they asked for. From my dad’s physician statement to his hospice doctor’s note requesting us to remain at his bedside during this critical time, itineraries, receipts and credit card charges to our Chase Sapphire Reserve card.

First off, they kept losing the paperwork we submit through their online portal, so between our accountant, Erica, and I, we had to upload multiple requests for the same documents at least three times each.

After almost 4 months of back and forth both on the phone and through the online portal, Eclaimsline denied the claims stating that my dad’s cancer was a pre-existing condition.

Huh? Eclaimsline has an Oncology department and saw my dad in order to make such a diagnosis and statement?!

Erica once again called Eclaimsline to speak to one of their reps to get more details and to re-open the case. This time round, this is exactly what the rep told her on the phone:

“Your claim is denied because it [the cancer] did not occur en route to your destination.”So basically we needed to be on the way to the airport when my father was diagnosed with stage 4 pancreatic cancer to qualify.

This is not only a ridiculous requirement, it’s cruel and shameful on Eclaimsline’s part.

Two separate phone calls with two very different answers for the same scenario.

The cancer diagnosis had not changed, but Eclaimsline’s reason for denial of coverage did.

If the situation with my dad does not qualify for a claim, then nothing else will.

- If you read the online reviews on Eclaimsline, you will see that even a death in the family does not qualify for a claim/refund/credit.

- Even in the midst of a travel emergency and crisis (think terrorist attacks, bombs being dropped around you and your airport is under siege), you will still not be covered. Read this blog post for more details.

I have also disputed the charges for the Malaysia to Hawaii portion of our return tickets since it was within the 3 month time frame for a dispute to be valid. That claim was denied as well.

From insurance protection claims to disputes, all claims were denied. Period.

Chase Sapphire Reserve card with travel protection is a scam.

They do not protect you at all.

In fact, they will give you more grief to an already stressful and challenging time.

I want to point out that this Chase card provides insurance coverage for: “Accidental bodily injury, loss of life, or sickness experienced by the Cardholder, a traveling companion or an immediate family member of the Cardholder or a traveling companion.”

Link to Chase Sapphire Reserve Card benefits coverage.

They scammed us by diagnosing my dad’s condition as PRE-EXISTING.

Note on Affiliate websites for Chase Credit Cards.

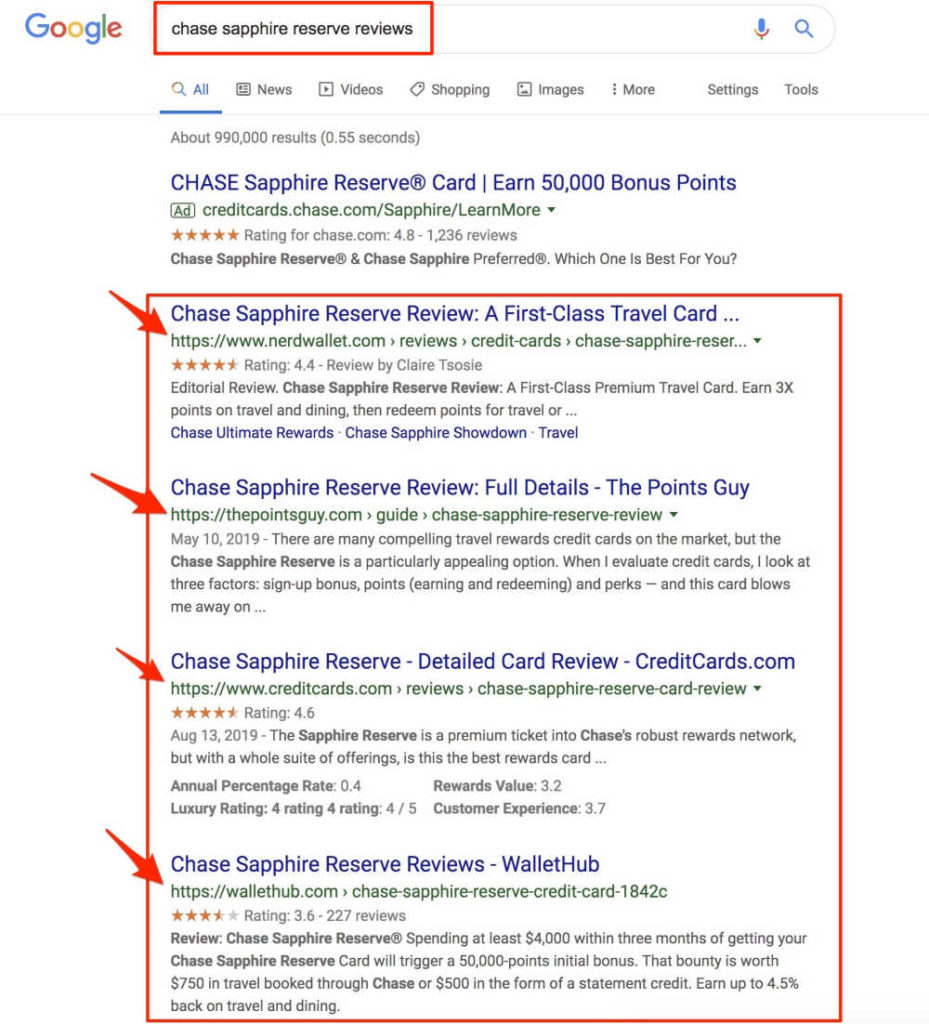

When you Google “Chase Sapphire Reserve card reviews”, you will see a lot of financial and travel related websites that will recommend Chase cards and all their reviews of the card will be outstanding.

All of these websites are affiliates for Chase and they make a commission when you click on their link/s, read their reviews and sign up for a Chase card. That’s one of the ways these websites monetize their business.

It is in their best interest to ONLY provide the positive side of Chase credit cards to get you to sign up, so don’t believe the hype about the travel insurance protection you’ll be getting with this credit card.

The Chase Sapphire travel insurance benefit is not designed to protect you. Its claim process is specifically designed to exhaust you through the tedious and bogus process. And its marketing, which Chase and their affiliates do a great job on, is designed to mislead you.

Learn from our mistake and don’t bother with this credit card. This is why Chase Sapphire Reserve card travel insurance protection is a scam.

Travelers beware.

Have you had the same experience with Chase credit card’s travel protection?

Please file a complaint with the Consumer Financial Protection Bureau (CFPB) and tell us about your experience with Chase below.

~Luanne

EDITED: Monday September 23 2019.

- Nine days after this blog was posted and tweeted to Chase, on September 13, my first claim was was approved, even though it had been previously denied. Twice.

- On the same day, Josh Barnes from the Chase Executive offices in Ohio called and left me a message. I called him back on Monday September 16 and left a voice message.

- 19 days after, on September 23, my second claim was approved, even though it had been previously denied. Twice.

EDITED: Tuesday September 24 2019

The Consumer Financial Protection Bureau (CFPB) wrote me to tell me my second claim was approved and that Chase/Eclaimsline has responded.

The reason why my claim was approved because I had added my dad’s hospice note to the blog which was not submitted to them. This is not only a sorry excuse because all they asked for was a physician’s statement for the claims (which I provided since day one). The hospice letter was additional to what they had asked for and I had taken it upon myself to ask the hospice doctor to write me a note.

IF a hospice note was all that was needed to get my claimed approved in the first place, why then did not ask for it immediately instead of asking for a physician’s note and then denying my claim anyway?

The Chase Executive office sent me this via snail mail. Which further proves my point on why did they not just ask for the hospice note in the first place as a requirement for my claims to be approved?

I call bullshit on both Chase and Eclaimsline.

29 Comments

Leave a Comment

You may also enjoy...

Love the food that loves you back

Get instant access to thousands of plant-based recipes and meal plans, no credit card or perfection required.

Luanne,

Thank you so much for sharing your painful experience with Chase’s travel insurance. It is mind boggling that they are knowingly misleading their customers and they DO NOT CARE. I’m especially glad that you pointed out how all of these credit card websites who rate “the best credit cards for travelers” are complicit in this. They do not care that the credit card products they are promoting are complete garbage, they just want the affiliate commission. I’ve have contacted several of them and shared that they Chase travel benefits do not provide the basic standard coverage for travel insurance, but these websites keep hawking the Chase card anyway. Chase must pay the highest commissions because those are the cards that are always at the top of the list even though the travel benefits are a complete joke.

Kellie,

I agree with you 100%.

I’m sure they pay the highest commissions because the annual fee alone is $450 plus and additional $95 for any subsequent card holders.

When you contact Chase directly on this issue, they will tell you that their insurance coverage is outsourced and it’s out of their control and they wash their hands off the whole thing.

If this does not qualify as an insurance scam, then I don’t know what does. Chase and Eclaimsline need to be reported to the CFPB for this.

https://www.consumerfinance.gov/complaint/

It’s deceptive AND criminal.

A friend shared this post with me, if you have not already I strongly suggest you report this to the CFPB via their website Their whole purpose is to stop Banks from pulling nonsense like this

Alexia,

Great idea. I’m on it. Thank you for letting me know about CFPB. Much appreciated 🙂

It is just mind blowing to learn about this travel card scam. I am wondering if informing the Democrats running for presidential nomination would do any good. They can LOUDLY bring it to the attention of the public during the debates and in TV ads, and even start legislation to stop Chase and others from using their deceptive tactics. These criminals need to be brought to justice!

Sadie, I agree that Chase and their insurance underwriting partner/s need to be brought to justice.

As far as using this issue as a political debate, I don’t know much about getting it into the right hands. However, everything has to start somewhere. By writing this I’m hoping to be able to at least get the ball rolling for the right person to potentially see it.

Thank you for your sharing this very frustrating and unfair situation to help others. I’m also very sorry to hear about your dad. As you said, having to deal with bureaucratic BS during an already heart wrenching time just adds insult to injury.

That being said, would you still recommend the Chase Sapphire Preferred? I didn’t know if one of its perks was also travel protection or not. If you do switch to another travel hacking type card, I’d be curious to know what you find.

Jennifer,

I’ve used both cards. One of the main reasons I upgraded was for the trip protection (although both cards have it) and the access to business class lounges through Priority Pass (only the Reserve card offers it).

For US airports, most of the business class lounges are always either packed OR they only recognize the carrier’s cards. Eg. The Delta Lounge, American Airlines Lounge etc. and you need the carrier’s credit card or lounge card. So I’ve never used the Priority Pass in the US.

If you are using it to earn points, both cards are good and the points for hotel, cars and flights are easily redeemed through their portal. Just know that their trip protection is bullshit for both cards.

They use the same insurance underwriter, Eclaimsline. You will need to buy additional insurance while paying the annual subscription fee which was designed to offer you “trip protection insurance”

So it all depends what you’re looking for. To earn points, they’re great. For trip protection, it’s a a definite no.

I’m very sorry you had this experience. Everything about this sucks. When my dad died, I had a terrible experience with United Airlines that still leaves a bad taste in my mouth 15 years later.

Just to share some of our experiences, as someone who doesn’t get any commission, I’ve looked at and used several travel cards. We’ve used the Chase Sapphire Reserve luggage delay benefit, and while I thought there were too many hoops to jump through, we did get reimbursed for purchases made in the week my husband’s bag was delayed on a Christmas trip. I appreciate that they include medical evacuation insurance, which many cards don’t, as I would not want medical care in some of the places we’ve traveled. We also make use of their primary car insurance on international rentals.

To answer the question about other benefits, as someone who lives overseas and travels internationally about 4 months of every year, this card has definitely been the best of the bunch for what we want. We get the $300 travel credit back early each year and use the Priority Pass benefit every time we travel, and at least in the international terminals of US airports, it’s been worth it. We’ve used it for a quieter space in an airport, but also for private napping rooms in Dubai and Atlanta, and for showers after a long trip (including in Atlanta).

You get more points per travel dollar spent than with other cards, and they are really easy to use. I like that they are not tied to a specific airline, but price quotes and flight times are comparable to everywhere else I look for flights. I appreciate that you can apply all of your points and add cash to finish a purchase. (e.g., Last year, we had enough points for 1.5 tix from Brazil to Korea and I could apply points and pay the difference. Other cards I’ve had haven’t made this as easy.) I’ve used points for a dive boat, hotels, flights, day tours, hop-on-hop-off bus tickets, museum tickets, etc.. I haven’t had another travel card with as many options for things to use them for.

Seems like an arbitrary process not designed to help you.

While I agree the points and benefits are great, the entire experience and their process and avoidance of paying out has left a bad taste in my mouth.

Also for the bigger US airports, we’ve never been able to use the Priority Pass. It’s always been carrier based (Delta Lounge, American Airlines Lount)and/or they’ve been too packed.

In just the past year we’ve used Priority Pass lounges in EWR, JFK, BWI, IAD, PHL (Minute Suites but the Centurion Lounge is the better option here), DFW, LAX, MAD, BCN, RAK, SJU, FLL and MIA. That’s just off the top of my head. In addition to lounges at MIA we also went to a Priority Pass restaurant on departure and arrival to use the $28pp dining credit for more than $100 of food. We did the same from Dulles before heading to KEF.

I think Chicago and Tuscon are the only places stateside we’ve traveled out of that have not been accessible but I suspect that’s because of AA’s domination there.

I am very sorry about your father, but this is a case of you not understanding Chases insurance. It’s a trip interruption type insurance in the case of a delay or flight cancellation. It’s never pretended to be a replacement for general travel insurance. Worked great for us last summer when our flight got cancelled and we couldn’t get out of New York for two extra days. Your situation would have required actual travel insurance, if you read what benefits that card has it’s fairly clear it involves trip events only and not prior to trip, that’s why we always buy travel insurance for anything out of country.

Ryan,

Why then was this family’s trip not covered? It was trip interruption too.

Delay and flight cancellations due to bombs being dropped all around the airport.

https://4wornpassports.com/beware-chase-card-travel-insurance

Btw, illness and death are covered. The scammed their way around it by diagnosing my dad’s condition as pre-existing.

https://www.chase.com/card-benefits/sapphirereserve/travel

I checked this out before I signed up.

I’ll preface this by saying I make no money by recommending the CSR and I’m sorry about your father, but I’ve had a vastly different experience.

I’ve had claims paid by CSR travel insurance twice. Once when WOW went out of business and another time when my husband’s job required him to train out of state. The first claim was for six tickets and more than $2,000.

Also, the difference between the CSP and the CSR is essentially $55, not $355, when you take into account that the CSR comes with a $300 travel credit applicable to anything from city parking meters to bus tickets.

Lucky you. This is exactly why their arbitrary claims process needs to be questioned and examined.

My scenario was a legitimate situation which their insurance provides coverage for yet, they made up different reasons for denial. Especially when they act as Oncologists by making unsubstantiated medical diagnosis based on nothing.

I want to know why and as consumers, it is our right to know when we spend so much money in one place.

Luanne – Sorry to know about your case, I also have a CSR card – hoping I am also going to run into the similar problems in the future. But wanted to tell you my opinion based on reading other people’s experience in the past:

What I have found in the past with insurances is, regardless of whether you knew that a condition like that existed or not, they treat that as a pre-existing condition if it is likely that the condition would have existed when tickets were booked.

I came across a certain case where the woman did not know that she was pregnant and found out later that she couldn’t travel, but the credit card company wouldn’t pay. So even though she did not genuinely know that she was pregnant, that really didn’t matter as to the decision to pay, as that is still considered a pre-existing condition when the tickets were booked.

Understood. Some illnesses are indeed pre-existing for a long time and it very well could have been.

However, the difference here is this:

1) He was officially diagnosed in late March 2019 and died in late August.

2) Eclaimsline’s reason for denial kept changing. It went from:

a) It was a pre-existing condition

b) The diagnosis did not happen while we were on the way to the airport

to

c) I did not submit a hospice letter with my claim and now that they see it on the blog, my claims were both approved.

All 3 reasons made no sense at all including C.

If all they needed was for a hospice letter for my claim to be approved, why did they just not ask for it in the first place.

The reason is simple. They will find every single excuse to deny your claims. That is their job and how they make money. The reasons they give are total bullshit, until they get called out in the bullshit they have spun.

My claim would not have been approved had I not written this blog and published it to our community of thousands of readers. Those who yell the loudest online is often heard and they admitted they read my blog.

Their scam was exposed. That’s the bottom line.

Luanne, Your post made me think of an NBC affiliate where I live (in the San Francisco Bay Area) that helps local residents with their consumer complaints and has a high degree of success doing so. It seems getting questioned by a news organization with a lot of reach is the kick in the butt some shady companies need to do the right thing, the thing they should have done in the first place. Funny, that.

I’m not sure where you live but it might be worth checking if there’s a news organization local to you that has a consumer investigation unit and reaching out to them. Eclaimsline’s practices are clearly unethical and it’s especially egregious that they put you through all of this while you were dealing with the loss of your father. I’d love to see you win this one.

Yup. I know about NBC affiliate when we used to live the the Bay Area.

We live in Hawaii now.

The internet has a far bigger reach so I’m gonna let it have a life of its own.

The real issue here is you didn’t understand the protection that Chase offers, and you conveniently left out details that would allow people to really understand what happened here. Instead, it’s worded to make you look good and Chase look bad, regardless of facts.

Matt,

If that was the case then why did they not spell it out and point out EXACTLY what it is that is being offered?

1) Instead they diagnosed my father’s cancer as PRE-EXISTING?

2) And then on the second call, they said the cancer did not occur while we were on the way to the airport.

I call bullshit on this.

Read EXACTLY what is covered instead of blaming the victim here. If you’re gonna troll, at least do it well and get your facts straight.

https://www.chase.com/card-benefits/sapphirereserve/travel

What’s Covered. This is not an exhaustive list. Examples include:

– Accidental bodily injury, loss of life, or sickness experienced by the Cardholder, a traveling companion or an immediate family member of the Cardholder or a traveling companion

– Severe weather that prevents the start or continuation a covered trip

– Terrorist action or hijacking

– Jury duty or a court subpoena that cannot be postponed or waived

– Financial insolvency of the Cardholder’s travel agency, tour operator, or travel supplier

——-

What’s Not Covered. This is not an exhaustive list. Examples include:

– Travel arrangements canceled or changed by a common carrier, tour operator, or any travel agency unless the cancellation is the result of severe weather or an organized strike affecting public transportation

– Change in plans or financial circumstances

– A pre-existing condition

– Traveling against the advice of a physician

– A declared or undeclared war

– Trips that exceed 60 days in duration are not covered

This is exactly how Chase scammed us. By diagnosing my dad’s condition as pre-existing to avoid a payout.

I guess I had much better luck. I had a trip planned to London/Paris. We had paid for everything with our Chase Sapphire Reserve: Hotel, airfare, train tickets, tour tickets. Then and about 5 weeks before we were to leave I fell and broke my ankle.

It was a lot of paperwork but I guess if they didnt require it they could be scammed. I basically had to get each of those places we had made purchases to send an email stating that our payment was indeed non-refundable. The process did take a couple of months but part of that was me taking a while to gather the requested paperwork (and the time it took for Virgin Atlantic to respond to me). Ultimately, Chase refunded us for everything except tickets to museums (which weren’t covered). Also, we had used points for a lot of the purchases and for that they paid us that back in cash.

This is what gets me. The process is ridiculous. Good for you that you managed to get your money back.

Seems like breaking a leg is more important than a terminal illness diagnosis and easier to get reimbursed for.

They scammed us by declaring that my dad’s cancer was a pre-existing condition even though the first time he was diagnosed at Stage 4 was late March. Pancreatic cancer diagnosis is usually never in the early stages. It pretty much goes from zero to four.

I hope this doesnt come off wrong, but why didn’t you buy refundable tickets from Mayalasia to Hawaii since you knew your fathers condition?

Also, what if they gave him a year and half to live instead of 6 months? What about 2 years? What about 9 months? Would you have gone on the trip to europe? What if it was stage 2 cancer and not 4 – would you expect insurance coverage? What if it wasn’t cancer but a broken bone? What if this happened to a good friend and not your father? Would you expect insurance to reimburse? I feel the insurance from the card is meant to protect you and whomever is on the trip, not every single possible situation that can arise to other people.

This is where they get you.

They do provide coverage and in this case: “Accidental bodily injury, loss of life, or sickness experienced by the Cardholder, a traveling companion or an immediate family member of the Cardholder or a traveling companion”

You can read it clear as day on their site:

https://www.chase.com/card-benefits/sapphirereserve/travel

Here’s the image of exactly what and what is not covered. They scammed their way and avoided a payout by diagnosing my dad’s condition as pre-existing when the first ANYONE knew of his condition at Stage 4 was in late march.

https://files.cleanfooddirtygirl.com/20190910143736/chase-bs.jpg

You should post this in Twitter to get their attention

Better for them to hear directly from Consumer Financial Protection Bureau than on Twitter, considering how busy that channel can get esp in recent times with our busy tweeting president 🙂

I’m so sorry for your loss! I am about to finish my medical training soon and was looking into high-benefit credit cards like this one. This post was a real eye-opener and I am going to steer far away from Chase. Unreliable, cruel, and deceitful. The audacity of them judging whether your father had a pre-existing condition leaves me speechless. My condolences to you. 🙁

Thank you for commenting and congratulations on your almost done medical training! Isn’t it amazing that they can diagnose a condition arbitrarily even though a physician statement AND hospice letter was submitted?

This is the reality of a faceless corporation and profits over people. Truly shameful.